Cow Protocol and its flagship product, CowSwap, have built a strong position in the market over the years, consistently maintaining around 30% market share. This solid foundation allowed the protocol to begin charging protocol fees starting early last year.

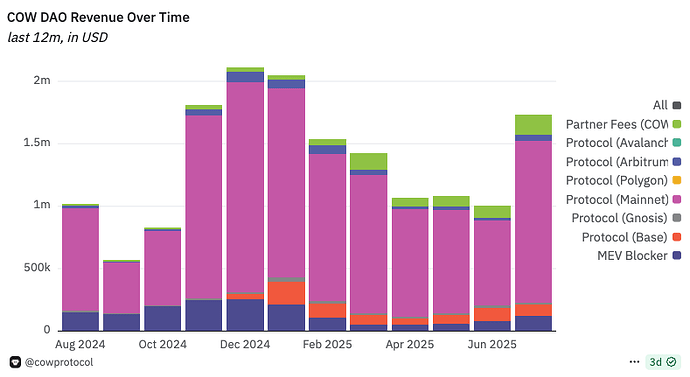

In addition to trading fees, the protocol also earns revenue from MEV Blocker, though that currently accounts for less than 10% of total revenues.

Over the past 12 months, Cow Protocol has generated $16.2M in protocol revenue.

Source: Dune

Monthly revenues have averaged around $1.3M, closely tracking broader market sentiment and trading volumes.

With its expansion to new chains, new integrations and ongoing work on cross-chain functionality, Cow is well-positioned to further grow its market share and strengthen its position in the ecosystem.

The team has consistently delivered, and I’m confident they’ll continue executing at a high level and pushing the project forward.

However, there’s one aspect that makes the business model more complexand arguably less effective, which could lead many potential investors to pass on the opportunity.

Currently, CowSwap users don’t pay any fees upfront since fees are instead “deducted” from the sell token if and only if the trade is successfully executed.

The protocol charges a fee equal to 50% of the user’s surplus, taken in the sell token. However, this protocol fee doesn’t go directly to the protocol itself. Instead, it’s first collected by solvers. At the end of each accounting period, these collected fees are converted into $COW tokens and then transferred to the protocol.

The key point here is understanding what truly drives protocol revenue.

We could discuss whether it is trading volume or surplus generation. Because stable-to-stable trades typically produce little to no surplus and are thus less profitable for the protocol. In contrast, trading volatile assets tends to generate higher surplus and therefore more revenue.

But that’s not the focus of today’s discussion. The key is:

the more people trade, the more revenue the protocol generates—which is directionally correct, even if the details are a bit more nuanced.

The benefits of converting all protocol revenues into $COW are fairly clear—it creates constant buy pressure on the token. However, it also introduces a risk: the protocol is adding a highly volatile asset to its balance sheet, one that’s tightly linked to its own success.

We’ll come back to that point later.

For now, let’s introduce another key piece of the system: the solvers.

Solvers are the behind-the-scenes operators who find the best possible prices for users. They’re a core reason why traders prefer Cow over traditional AMMs, because they consistently get better quotes (and MEV protection).

Of course, solvers deserve to be rewarded for the valuable service they provide. But this is where, in my view, a structural issue arises.

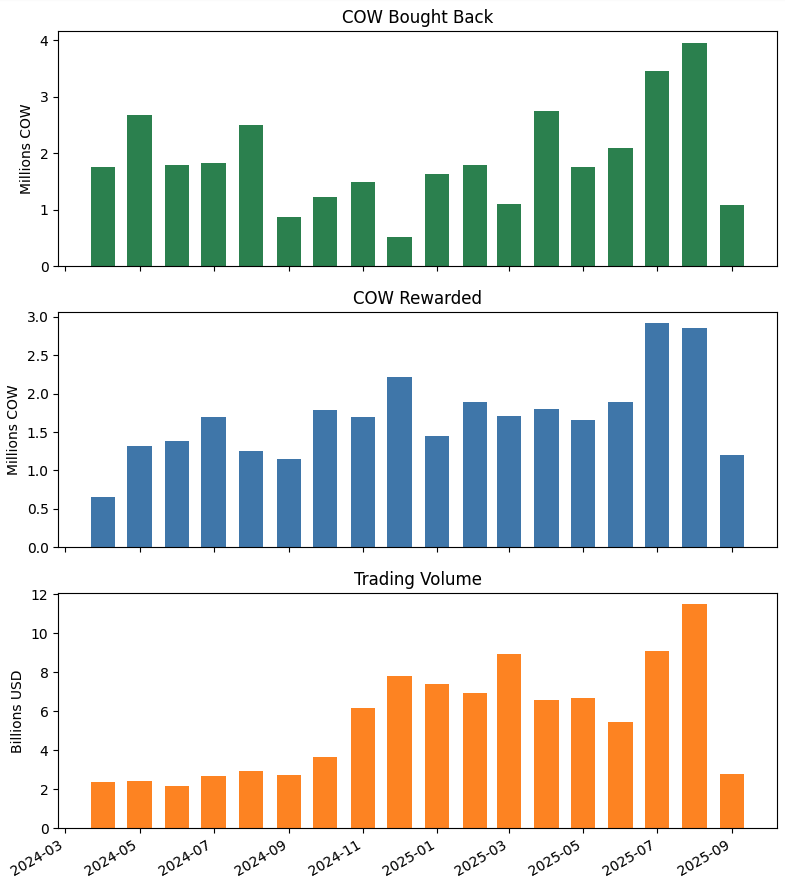

Currently, solvers receive fixed rewards in $COW—for actions like submitting bids, winning auctions, etc. This creates a negative feedback loop for the protocol: the higher the price of $COW, the higher the cost of incentivizing solvers.

To be fair, the $COW reward budget is reviewed and adjusted every six months. Still, the system introduces unnecessary risk for both the protocol and the solvers.

Cow Protocol’s goal is to offer rewards that are high enough to keep solvers engaged and competing. It ultimately leads to better prices for users.

Solvers, on the other hand, aim to cover their costs and make some profit.

But when the medium of exchange used in this relationship is an 80-volatility asset like $COW, it becomes harder for both sides to plan, price, and operate efficiently.

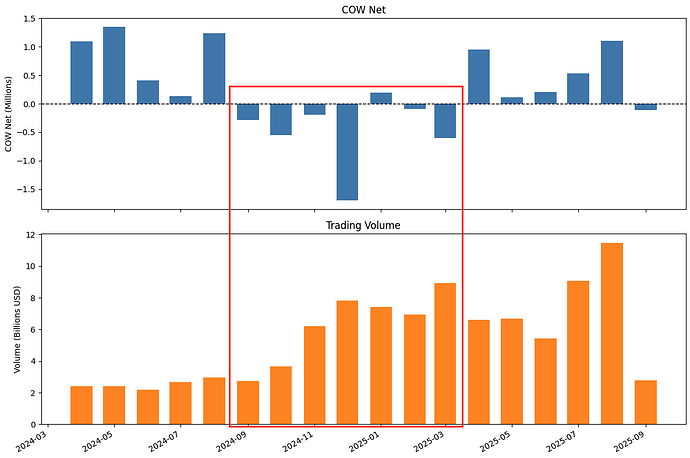

Here’s a chart comparing the protocol’s monthly revenues to the rewards paid out to solvers. It highlights the growing tension between revenue generation and incentive costs—especially as $COW price fluctuates.

Note: this chart isn’t perfectly precise, as I used average monthly $COW prices to better illustrate my point.

Source: Dune

Cow recorded peak revenues in December 2024, as the broader crypto market rallied following Trump’s election and the perceived positive sentiment it brought to the space.

But the rise in overall market prices (including $COW) also drove solver rewards to a record high of $1.9M in December, matching protocol revenues for the same month.

So while December marked a record month for revenue, the protocol effectively broke even—highlighting the cost side of the current incentive structure.

Again, the data might be slightly off due to averaging, but the overall point still stands.

To understand the full picture: solvers first send the collected protocol fees to the protocol. Then, the protocol calculates how much is owed to solvers and distributes $COW tokens to them as rewards.

But from the protocol’s (or an investor’s) perspective, these rewards are purely costs and they need to be accounted for as such. While we don’t have visibility into the exact cost structures of solvers, it’s reasonable to assume they’re not simply holding these rewards. Most will likely sell the $COW tokens shortly after receiving them to cover operational costs and lock in profits.

Let’s assume similar trading volumes in Month A and Month B. That would result in roughly the same protocol revenues and solver activity in both months.

However, in Month A, the price of $COW was $0.30, while in Month B, it was $0.90. Even though everything else stayed flat—including revenues—the protocol’s expenses tripled, purely because the price of $COW went up.

Yet the solvers’ real operating costs didn’t change between the two months. This highlights a core issue: the current reward structure doesn’t accurately reflect the underlying economics—it introduces volatility and inefficiency where there shouldn’t be any.

As mentioned earlier, the current design creates a negative feedback loop for the protocol: the higher the price of $COW, the more expensive it becomes to reward solvers—regardless of whether their actual costs have changed. This misalignment adds unnecessary pressure on the protocol’s economics and makes long-term sustainability harder to model.

What I’d like to open for discussion is this: why not reward solvers in stablecoins instead?

Some argue that paying rewards in $COW helps align solvers with the protocol’s success. That sounds great in theory, but does it actually work in practice?

If true alignment is the goal, there are other, potentially more effective ways to achieve it.

For example, the protocol could offer solvers token options, vesting-based incentives, or discounted $COW allocations—methods that create long-term alignment without exposing the protocol to unnecessary volatility or cost inflation.

The protocol and solvers could sit down together and work out a cost structure based on USD terms. This would give solvers more stable and predictable revenue, while allowing the protocol to better manage and forecast its expenses. It’s a win-win that reduces risk for both sides.

Based on the margin this structure would leave the protocol with, a portion of the remaining revenue (after deducting these solvers costs) could still be allocated to $COW buybacks. That way, if buy pressure is a goal, it can still be achieved in a more controlled and sustainable manner.

And before I wrap up, I have one request that I think would benefit everyone.

Right now, we can track protocol revenue by chain, but we have no visibility into how solver rewards are distributed across chains, since all rewards are currently settled on mainnet.

It would be helpful to see chain-level economics, including both revenue and associated costs, to better understand where the protocol is most efficient and where it has room to improve.

I hope this post helps spark a thoughtful discussion around the current token design and the role of $COW within the broader ecosystem.