One of the core drivers of the success of CoW Protocol is its solver rewards mechanism. Because CoW Protocol pays solvers for winning batches, they do not need to take any economics from those batches – making solver bidding strategies easier and more competitive, and ultimately generating more surplus for users.

Beyond compensating solvers for the value they generate, these rewards also strengthen long-term alignment with the ecosystem. By holding COW, solvers gain a direct stake in the Protocol and the ability to shape its Governance. This alignment is already evident, as leading solvers consistently retain a significant share of their COW rewards.

Despite being core to the success of the protocol, distributing solver rewards has historically generated an inflationary impact on the circulating supply of COW tokens. This ceased being the case in April of last year when CoW DAO began using a portion of CoW Protocol revenue to buy back COW tokens on the open market – thereby counteracting the impact of solver rewards on token supply.

Buybacks have now been live for over a year and in that time the COW token supply has remained stable while CoW DAO profit attributable to CoW Protocol has increased.

Simple Summary

CIP-38 introduced a change to CoW Protocol’s protocol fee mechanism and a new mandate to the CoW Core Treasury Team.

After 4 weeks of running the new ranking, we will analyze the caps for rewards. The caps will be reduced in case of overspending (with respect to the budget defined in CIP-36) and increased in case of underspending, as an amendment to CIP-36. At this time we will also start with automatic conversion of protocol fees to COW tokens.

This mandate led the treasury team to initiate tests on the conversion of protocol fees to COW, starting on 2024-04-17. The treasury team now has a streamlined weekly TWAP process, leading to an overall negative emissions amounting to - 3,360,807 COW since starting.

Currently, the Treasury Team’s operational plan is to ensure “net zero emissions”, aiming to buy from the market the same amount that is paid to solvers for a week. Given the way the process is performed, token buyback is slightly superior to solver emissions.

Detailed Review

Official buyback query: https://dune.com/queries/5273980/8661207

COW buyback start date: 2024-04-17

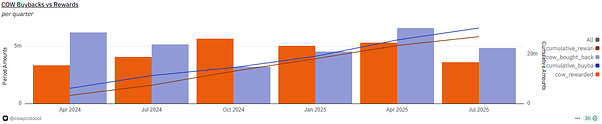

Figure 1 - CoW Buybacks per quarter

Left axis denotes amounts in the period in COW. Right axis denotes cumulative amounts in COW

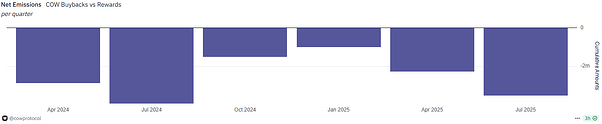

Figure 2 - Solver mechanism net emissions per quarter

Table 1 - Solver mechanism emissions from start of buyback period(calculated on Aug 11th 2025)

From the passing of CIP-38, the Treasury Team tested different setups that included:

-

Phase 1 - TWAP tests for duration and network

- In this stage, the Treasury Team pursued tests between Mainnet and Gnosis Chain to assess slippage impacts, time interval frequency and operational process

- Mainnet TWAP 12h interval per part vs. Gnosis Chain TWAP 12h interval per part

- Period: Until 2024-05-03

- Amount of WETH sold: 72.9 ETH Mainnet, 70 ETH Gnosis Chain

- Mainnet TWAP 12h interval per part vs. Gnosis Chain high frequency TWAP 5min interval per part

- Period: Until 2024-05-10

- Amount of WETH sold: 33.23 ETH in Mainnet, 34.25 ETH in Gnosis Chain

- Mainnet TWAP 12h interval per part vs. Gnosis Chain TWAP 12h interval per part

- In this stage, the Treasury Team pursued tests between Mainnet and Gnosis Chain to assess slippage impacts, time interval frequency and operational process

-

Phase 2 - Stabilisation of Mainnet TWAP

- Post testing, the Treasury Team decided to implement TWAPs only on Mainnet given lower slippage and the concentration of the majority of revenue in Mainnet (hence reducing the need for bridging of funds). During this phase the TWAP destination was the main CoW DAO Treasury.

-

Mainnet TWAP 12h interval per part

- Period: Until 2024-07-25

- Amount of WETH sold: 396.41 ETH in Mainnet

-

- Post testing, the Treasury Team decided to implement TWAPs only on Mainnet given lower slippage and the concentration of the majority of revenue in Mainnet (hence reducing the need for bridging of funds). During this phase the TWAP destination was the main CoW DAO Treasury.

-

Phase 3 - Ensuring better visibility

- The Treasury team deployed a Safe - “CoW Buyback Recipient” - that since 2024-08-07 has been the main receiver of COW bought back to provide better transparency and operational flows.

- Funds in the Safe are mostly idle with the treasury team using them for strategic initiates or solver rewards budget top-ups.

- There have been extraordinary buybacks since this period started, that still happened in other treasury safes, due to price movements that led the TWAPs to go out of range, and due to operational circumstances that led TWAPs to be paused for some weeks over the holidays.

In order to reach this goal of “neutral emissions”, given price fluctuations, the Treasury Team has now added a Buyback target of weekly COW emissions + 20% to ensure a continuation of net negative emissions, and will continue to adjust the buyback target ensuring always a minimum of net zero emissions.

Overall the Treasury Team thanks the Core Team for its collaboration during this period. The Treasury team is evaluating ways of automating the buyback process to ensure lower disruption in case of human resources issues.

Relevant DAO wallets:

“CoW Treasury” (eth:0x616dE58c011F8736fa20c7Ae5352F7f6FB9F0669)

“CoW Buyback Recipient” (eth:0xA2BFc70e63a48BDfc3F8013a44B04b6c33fb8200)