The recent ratification of CoW DAO’s governance proposal, CIP-75, passed in November 2025, has established a revenue distribution model that warrants community examination. This structural change, while approved through an official governance vote, demonstrates a concerning convergence with a contested precedent established by Aave Labs in December 2025. Specifically, Aave Labs was found to be routing a substantial amount of interface fees to a private address, an action delegates labeled as “stealth privatization.”

Revenue Distribution and the Fiduciary Duty of Service Providers

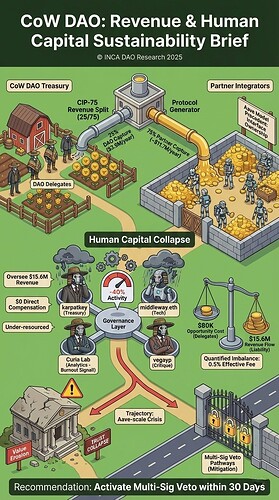

CIP-75 fundamentally shifts the default revenue share on partner fees, moving from a previous 50/50 split to a new distribution that allocates only 25% of the fees to the DAO treasury while directing the remaining 75% to partner integrators. Although the mechanism of CoW’s official governance differs from Aave’s unilateral action, the economic result is functionally similar: the majority of value generated by the protocol is channeled toward distinct, legally wrapped entities.

Beyond the technical distinction between the core protocol, which the DAO governs, and the proprietary frontend product maintained by a private company. The debate overlooks the inherent fiduciary duty assumed by tokenized entities following the Initial Coin Offering (ICO). Service providers associated with the DAO, such as Foundations or Labs, were initially and explicitly funded by the community, operating with a clear mandate to act solely in the token holders’ best interests.

Therefore, any proprietary interface integration should be conceptualized as being periodically licensed to the DAO in exchange of a revenue percentage fee. Each service provider must pay to monetize the DAO’s established brand, reputation, and underlying user base, rather than act as external layers entitled to overstep the DAO treasury.

Human Capital Fragility and the Collapse of Oversight

Concurrently, the governance oversight required to effectively monitor this substantial revenue flow is critically dependent upon under-compensated participants. The core group includes specialized roles like the analytics provider (Curia Lab), treasury operations (karpatkey), technical implementation (middleway.eth), and forum moderators (le-shy), alongside dozens of other permissionless human capital contributors.

Despite the community collectively generating millions in annual intellectual labor value through crucial governance management and bearing significant personal opportunity costs, their formal compensation often remains opaque. This creates systemic risk for grants misuse through implicit remunerations and, more importantly, leads to the disengagement, half-time participation, and eventual burnout of essential governance nodes.

Consequently, the resulting systemic governance apathy should be recognized as a broader design-induced condition where those participants most capable of detecting and auditing value extraction are simultaneously provided with the least tangible incentives in the overall financial outcome.

Conflict of Interest and Solutions for DAO Sustainability

The structural relationships within the CoW DAO are effectively non-orientable because the entities that benefit as revenue recipients are also permitted to fully participate in defining and voting upon the revenue allocation parameters. This participation inherently creates a problematic loop of circular accountability and systemic conflict of interests.

Given that the existing extraction model demonstrably contributes to governance inefficiencies, the path forward could reverse the current misalignment and revitalize core community initiatives with the implementation of direct tokenomics compensation for permissionless roles. Incentives should include rewards to delegates, researchers, moderators, marketers and developers to promote structured forum participation via flexible, transparent, and milestone-based funding mechanisms.

© INCA DAO Research 2025. Reproduction is reserved for formal licensing engagements.