CIP: 70

title: Operational CoW DAO Safe Renewal 2

author: notsoformal

status: Draft

created: 2025-07-15

Simple Summary

CoW DAO’s products have entered a new acceleration phase with an active network expansion roadmap. To ensure that the products work correctly across chains, the Core Team has had the need to test several operations across networks, leading to the spend of the majority of “operations” funds.

CoW DAO has a number of operational needs, including various ecosystem related transactions and operations. These require low funding amounts, but payments that are sent frequently (eg. network fees, testing, user studies etc.)

This CIP asks for an allocation of 50 ETH from the CoW Treasury, in line with prior interactions (CIP-43: Operational CoW DAO Safe Renewal, in May 2024, and CIP-25: Operational CoW DAO Safe, in May 2023), given that total allocation is now under 10 ETH.

Additionally, this CIP proposes a reorganization of the Safe Signers to ensure the Foundation Director and Foundation Operator have control over the funds and are involved in the requests for funding from the Core Team.

Motivation

This CIP asks to transfer 50 ETH (ca. 112k USD equivalent) from the CoW DAO Treasury (eth:0x616dE58c011F8736fa20c7Ae5352F7f6FB9F0669) to the CoW DAO Ops Safe (eth:0x46861c73480d35AA285f1420Ba80e76766F9885c).

During the last 15 months (Apr 2024 to Jul 2025), the Ops Safe has mainly been involved in the funding of:

- Gas and smart contract initiation costs

- Testing initiatives, namely:

- UX user interviews

- Frontend testing

- Fee mechanism testing

- ETH Flow smart contracts top up

- Bug Bounties , namely a bounty paid through Immunify

- Testing CoW AMMs and benchmarking to competitor AMMs

These funds will be used as necessary in the development of the CoW Protocol Suite and related undertakings, namely:

- Deployment of smart contracts;

- Audit services for smart contracts;

- Bounties;

- Testing of features (like partial orders, milkman upgrades, and others);

- User studies;

- Funding of the ETHFlow refunder wallets;

- Funding for gas and signers;

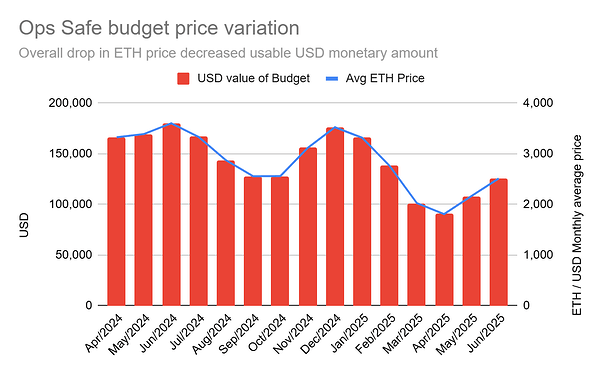

A relevant impact on the USD amount requested was felt in this period, as ETH prices dropped from over 3 thousand USD, to values orbiting lower than 2 thousand USD, leading to some overutilisation for testing phases:

Even with the price fluctuation impact - whose dip in Mar-Apr coincided with more transaction testing due to new network launch in Q2/Q3 - the team was able to “recycle funds” being able to generate over 309k Transaction volume in USD.

The majority of these funds were spent in gas payments, launching of smart contracts and testing bots. The biggest transaction, paid by the CoW DAO Ops Safe relates to a Bounty paid in Immunify.

| Source name | # Transactions | Total Tx. Value (USD) | Average Tx. Value |

|---|---|---|---|

| CoW DAO Ops EOA - Arb1 | 64 | -15341.74 | -239.71 |

| CoW DAO Ops EOA - GC | 68.00 | -63,780.45 | -937.95 |

| CoW DAO Ops EOA - Mainnet | 168.00 | -157,726.99 | -938.85 |

| CoW DAO Ops EOA - Polygon | 1.00 | 0.00 | 0.00 |

| CoW DAO Ops Safe - Mainnet | 1.00 | -16,288.84 | -16,288.84 |

| CoW Ops Finance Funder - Arbitrum | 6.00 | -2,123.95 | -353.99 |

| CoW Ops Finance Funder - Base | 4.00 | -3,216.07 | -804.02 |

| CoW Ops Finance Funder - Binance Smart Chain | 6.00 | -523.22 | -87.20 |

| CoW Ops Finance Funder - Gnosis | 17.00 | -2,878.89 | -169.35 |

| CoW Ops Finance Funder - Mainnet | 35.00 | -21,174.84 | -605.00 |

| CoW Ops Finance Funder - Optimism | 8.00 | -770.78 | -96.35 |

| CoW Ops Finance Funder - Polygon | 15.00 | -1,232.10 | -82.14 |

| Expense wallet 2 - Gnosis | 17.00 | -24,273.99 | -1,427.88 |

| Expense wallet 2 - Mainnet | 1.00 | -36.31 | -36.31 |

| Grand Total | 411.00 | -309,368.18 | -1,576.26 |

All rules for the management of these funds follow from the initial CIP-25, which will be taken as recommendations.

Further top-ups will require a summarised expense report of prior funding along with another CIP.

The assets in the operational CoW DAO Safe will remain idle (no asset management).

Proposal

- Transfer 50 ETH (ca. 112k USD equivalent) into from the CoW DAO Treasury (eth:0x616dE58c011F8736fa20c7Ae5352F7f6FB9F0669) to the CoW DAO Ops Safe (eth:0x46861c73480d35AA285f1420Ba80e76766F9885c)

- Proceed to the change of signers to include the Foundation Director and Foundation Operator in a 2/3 signing threshold.

- Add CoW DAO (0xcA771eda0c70aA7d053aB1B25004559B918FE662) as a module of the CoW DAO Ops Safe to ensure ultimate ownership by CoW DAO.