Summary

This CIP proposes a hybrid reward model where solvers receive 25% of batch surplus only when CoW Protocol itself collects fees from that surplus. Users keep 50%, the protocol retains 25%. By directly tying solver rewards to the value they create, this model encourages solvers to maximize batch surplus and shifts solver behaviour from a “maximize my reward” mentality to a “maximize protocol benefit” mentality.

Motivation

Where protocol revenue comes from

Protocol revenue exists only when a solver generates and executes surplus. No surplus means no revenue. It is therefore natural that solvers share in that revenue when the protocol actually collects it. We propose a redesign of how solver-generated revenue is redistributed.

Current Solver Reward Mechanism

CoW Protocol currently uses a second-price auction mechanism for solver rewards, with a fixed reward cap. The winning solver’s reward is determined by the difference between their solution’s score and the next-best solution’s score (the “second-price”), and this reward is capped at an upper bound (for example, ~0.012 ETH on mainnet).

If the winner fails to execute any winning solution on-chain by the deadline, the score of that solution is set to zero for payout purposes, so the payment can be negative but is lower-capped at 0.010 ETH per auction. This design was intended to foster competition and to keep reward outflows predictable by not exceeding the cap.

However, there is a misalignment in how surplus is shared: currently, user surplus is split 50/50 between the user and the protocol, and solvers do not receive a direct share of that surplus. A solver’s profit comes only from the capped reward, regardless of how much value their solution adds beyond the next-best. Over time, this has revealed several incentive issues and risks:

-

Limited Incentive to Maximize Surplus: Once the reward cap is reached, additional surplus brings no extra benefit to the solver. In practice, 3–10% of auctions hit the cap https://dune.com/queries/5310652/8711765 , and there are cases where a solver generates tens of thousands of dollars in surplus for the protocol but receives only a small capped payout due to strong competition. This dynamic pushes solvers to raise their fees to avoid surplus being truncated by the cap, rather than maximizing true surplus. While it secures payouts for the solver, it reduces net surplus for both users and the protocol and diverts effort away from real improvements like better routing or liquidity integration.

-

Cartel Risk: Because only the top solver earns a reward, rational solvers are incentivized to maximize payout, even if it means reducing competition. A plausible outcome is the creation of off-chain solver auctions, where solvers run their own competition internally and only submit the winning solution to CoW. From the protocol’s perspective the winner looks the same, but with no genuine second bid, the reference score collapses to zero, allowing the on-chain winner to repeatedly claim the maximum capped reward. Winners don’t change, but their rewards are artificially inflated, undermining competition and discouraging surplus improvements.

-

Misaligned Effort: Similar misalignments were observed in quoting before CIP-72, where solvers overbid quotes to farm rewards, harming execution quality. The same pattern can occur in solving: solvers focus on exploiting mechanics to maximize their payout rather than maximizing protocol benefit.

In summary, the current capped reward mechanism, while keeping costs predictable, does not reward solvers for creating a large surplus and even creates perverse incentives to game the system or collude. We need a solution that preserves competition and cost controls while directly aligning solver rewards with the surplus they generate.

Proposed Solution: Surplus Sharing with Solvers

Solver rewards gain a surplus-sharing component, applied only when CoW Protocol charges a protocol fee. The solver’s reward will be whichever is larger:

-

the capped second-price reward, or

-

25% of surplus (half of the protocol fee).

The remaining surplus is split between the user (50%) and the protocol (25%). If no protocol fee is charged, solvers fall back to the capped model.

To keep the system sustainable, a weekly per-solver cap of 150,000 COW applies to total rewards. This ensures token emissions remain predictable and within budget, while still giving solvers strong incentives to maximize surplus. The cap acts as a safety valve: it prevents a small number of high-volume solvers from absorbing disproportionate rewards, thereby preserving competition, while still allowing them to benefit proportionally up to a high ceiling.

The incentive structure focuses solver behavior on growing batch surplus through better routing, tighter pricing, and reliable settlement rather than gaming second-price gaps. High performers are compensated in proportion to the user value they create, while low-impact activity remains constrained by the cap. By reinvesting part of its fee into solver incentives, the protocol maintains a healthy, competitive platform without runaway payouts.

Data and Analysis

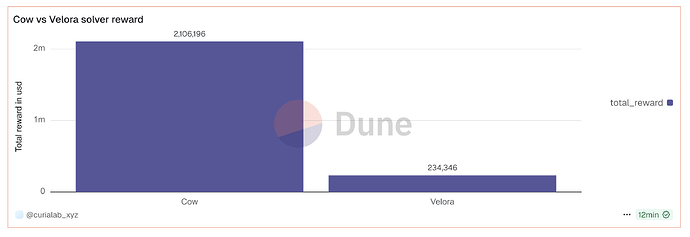

Methodology:

We analyzed one week of batch auctions (Aug 12–19, 2025) using Dune query #5662042. Solver rewards were computed under two systems:

-

Current model – capped second-price reward.

-

Hybrid model – solver reward = max(capped reward, 50% of the protocol fee = 25% of surplus), but only in batches where the protocol itself charged a fee.

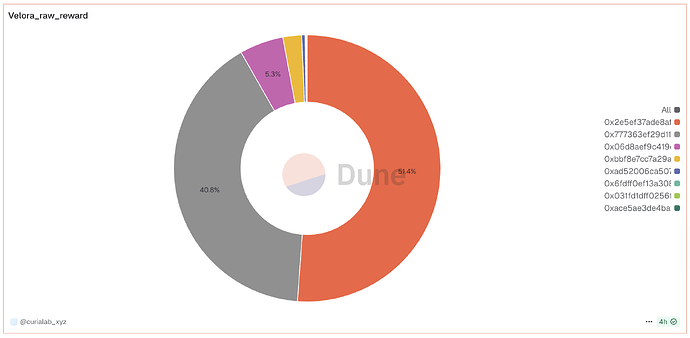

For each solver we tracked:

-

fair_reward_cow – the solver’s total final reward (capped second-price + capped surplus-share).

-

uncapped_reward_from_protocol_fee – how much the solver would earn from 50% of protocol fees without any limit.

-

capped_reward_from_protocol_fee – the actual surplus-share received after applying the weekly per-solver cap of 150,000 COW.

These results were directly compared to rewards under the current capped system, allowing us to measure the net effect of the proposed change. All values were converted to COW using 24h average prices and aggregated across the week.

Results:

-

Solvers with capped rewards: Under the hybrid model, solvers like Rizzolver, Portus, PLM, and Apollo would have earned well above 150k COW from protocol-fee sharing. However, due to the 150k/week per-solver limit, their additional rewards were cut off at that ceiling. Even with this restriction, their weekly earnings still rose substantially compared to the current system.

-

Other Solvers: other solvers gained proportionally more, since they rarely hit the 150k cap. Many doubled or tripled their rewards; some who previously earned almost nothing turned positive once surplus contributions were included.

-

Protocol outlay: Total solver rewards across all solvers increased from about 502k COW under the old system to 863k COW under the capped hybrid system. Without the 150k cap, the outlay would have been higher, but the cap ensures that aggregate token emissions remain predictable and sustainable.

In summary, the capped-only model systematically underpaid the solvers generating the most value, while the hybrid surplus-sharing model rewards them proportionally and keeps overall issuance controlled.

What this implies

Because payouts scale with realized protocol fees, solver profit rises and falls with protocol profit → solvers become direct partners in protocol growth. The model is closer to Proof-of-Stake validator economics: specialized operators are rewarded proportionally to the value they contribute, and only when the protocol itself generates revenue. Just as validators secure and grow PoS networks by aligning their upside with protocol fees, solvers in CoW Protocol are incentivized to maximize surplus and protocol revenue.

Conclusion

The current solver reward design often diverges from genuine surplus creation. Since all protocol revenue comes from solver-generated surplus, it is natural that solvers receive a share of that revenue when the protocol collects it. Stable, surplus-based rewards encourage solvers to invest in new algorithms, liquidity integration, and efficiency, focusing their efforts on genuine improvements rather than trying to extract more rewards from the protocol through abuse of the current system.

Let solvers, users, and CoW all share fairly in the value they create. Mooo🐮